nj payroll tax calculator 2020

Updated February 3 2022. Determine taxable income by deducting any pre-tax contributions to benefits.

Reliable Accountant Wise Investment Nicholas J Coco Cpa Bloglovin Invest Wisely Bookkeeping And Accounting Accounting Services

State of NJ - Department of the Treasury - Division of Taxation.

. Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll. Keep your finger on the pulse with special workforce insights and feature articles by signing up for our monthly newsletter. Stay up to date on vaccine information.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Federal Payroll Tax Rates. PANJ Reciprocal Income Tax Agreement.

Salary paycheck calculator guide. The steps our calculator uses to figure out each employees paycheck are pretty simple but there are a lot of them. FREE Paycheck and Tax Calculators.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. Get Started With ADP. Free New Jersey Payroll Tax Calculator and New Jersey Tax Rates.

So the tax year 2021 will start from July 01 2020 to June 30 2021. No personal information is collected. Your New Jersey employer is responsible for withholding FICA taxes and federal income taxes from your paychecks.

Discover ADP For Payroll Benefits Time Talent HR More. New Jersey Hourly Paycheck Calculator. Over But Not Over Of Excess Over 0 385 15 0 385 673 577 20 385.

Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. Your employer will withhold 145 of your wages for Medicare taxes each pay period and 62 in Social Security taxes. Applicable to Wages Salaries and Commissions Paid on and after October 1 2020 RATE A WEEKLY PAYROLL PERIOD Allowance 1920 If the amount of taxable The amount of income wages is.

Call NJPIES Call Center for medical information related. In the world New Jersey has the. Post-Retirement Contributions to a Section 403 b Plan.

Figure out each employees gross wages. Medicare and Social Security taxes together make up FICA taxes. This New Jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. How Your New Jersey Paycheck Works. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator.

Switch to New Jersey salary calculator. The withholding tax rates for 2021 reflect graduated rates from 15 to 118. This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. State of new jersey 2020 payroll calendar january february march april sun mon tue wed thu fri sat sun mon tue wed thu fri sat sun mon tue wed thu fri sat sun mon tue. Out of all the states in the US New Jersey has the highest population density highest percent urban population and the densest system of railroads and highways.

File and Pay Employer Payroll Taxes Including 1099 1095 Electronic Filing Mandate. New Jersey tax year starts from July 01 the year before to June 30 the current year. Our paycheck calculator is a free on-line service and is available to everyone.

Tax to be withheld is. How to calculate net income. Ad Process Payroll Faster Easier With ADP Payroll.

Commuter Transportation Benefit Limits. New Jersey Payroll Tax Rates. Calculate your state income tax step by step.

Gross wages are the total amount of money your employee earned during the current pay period. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Check the 2020 New Jersey state tax rate and the rules to calculate state income tax 5. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you. The 118 tax rate applies to individuals with taxable income over 1000000.

New Jersey Salary Paycheck Calculator. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. COVID-19 is still active.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Switch to New Jersey hourly calculator. Employer Requirement to Notify Employees of Earned Income Tax Credit.

Heres how it works and what tax rates youll need to apply. New Jersey Gross Income Tax. Our online Annual tax calculator will automatically.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

State W 4 Form Detailed Withholding Forms By State Chart

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planning Your Tax Deductions Tax Refund Tax Return

2021 New Jersey Payroll Tax Rates Abacus Payroll

Tax Withholding For Pensions And Social Security Sensible Money

How Do I Handle My State Returns If I Live In Nj But Work In Ny Tax Refund Tax Software Turbotax

Zip Code 19342 Profile Map And Demographics Updated March 2020 Coding Demographics Map

New Jersey Paycheck Calculator Adp

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

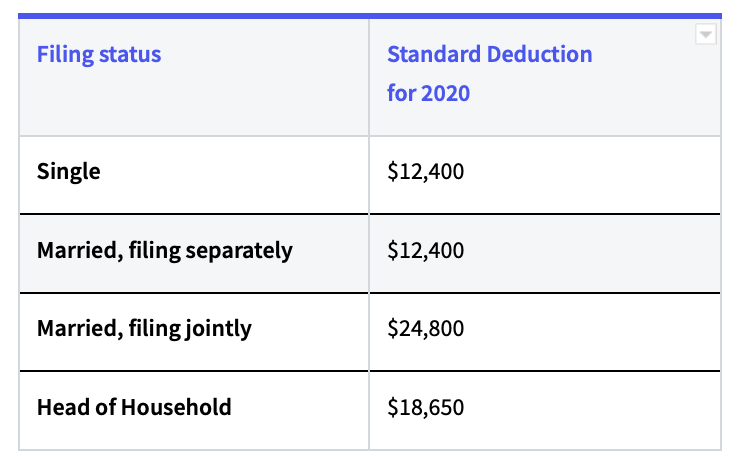

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Alvarez Marsal Tax Internship Summer 2020 Tax Consulting Tax Accounting

Self Employed Tax Calculator Independent Contractor Lili Banking

2020 New Jersey Payroll Tax Rates Abacus Payroll

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

What Are Marriage Penalties And Bonuses Tax Policy Center

Federal Income Tax Guide 2022 Tax Brackets Deductions And More Income Tax Tax Guide Tax Brackets

New Jersey Nj Tax Rate H R Block